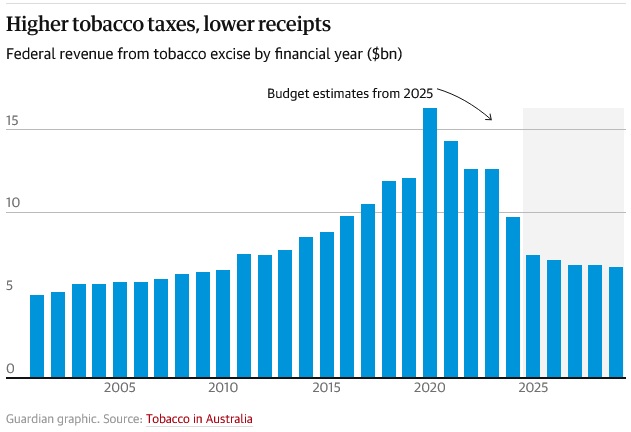

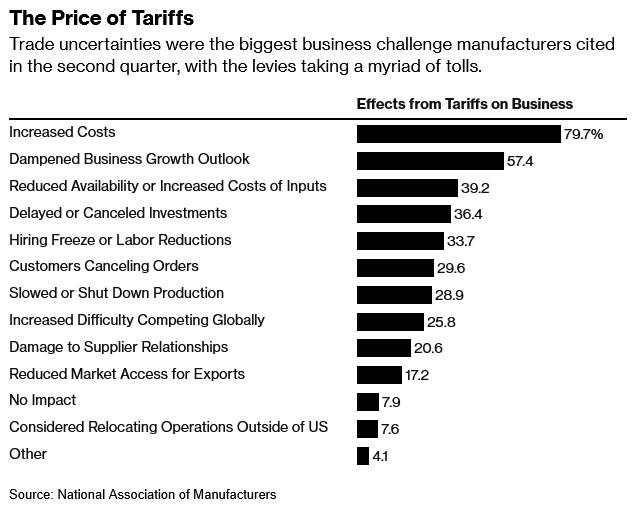

Hi there, Please note that this will be the last newsletter for a while because I'm going to be in the West Indies watching far too much test cricket over the next few weeks, so won't have the time to keep up with current events. This being an economics newsletter, I'll keep my thoughts on the current state of the Australian men's team to myself! 😑 Anyway, since the last update I've written four notes. The first was on the limits to building out the suburbs, which went over some housing affordability contradictions in Australian politics before diving into a new working paper by Harvard's Ed Glaeser and Wharton's Joseph Gyourko, which I think also applies to Australia. Next up was a look at why the Kiwis are so unproductive. As bad as measured productivity growth has been in Australia over the past decade or two, it has been much worse in New Zealand! I followed that with a post on why taxing unrealised gains is almost always a bad idea. The world of Piketty, Saez, and Zucman just isn't the one in which we live (as an aside: could their take on Argentina's Javier Milei have been any further off the mark?), and so wealth taxes, including Treasurer Jim Chalmers' planned superannuation tax grab, are almost always a big fat fail. Finally, I commented on the Albanese government's latest adventures in industrial policy: so-called sustainable aviation fuels, or SAF. While Transport Minister Catherine King is correct that the subsidies will benefit farmers, some niche manufacturing, and companies like GrainCorp, it's a high price to pay for a largely symbolic win that will come with a bevy of costs that make the rest of us worse off. The sooner the Albanese government learns some economics, the better! Other bits of interestIt's no secret that the Australia government's approach to smoking has been an unmitigated disaster. The Guardian had another great piece on that topic, pointing out that with taxes now accounting for 70% of the price for a packet, the black market has flourished and tax revenue has collapsed. Here's a chart from the post:  You would think we'd learn. But no, because the government's heavy-handed approach to vapes is producing similar results. As reported by the Daily Telegraph , just 0.06% of vape sales, excluding those involving prescriptions, are occurring legally through a pharmacy. Meanwhile, an estimated 10 million vapes are sold nationally every month on the black market. How could they have known? Well, they could have read Aussienomics back in January 2024 when I wrote that the Albanese government's vape policy would lead to "higher prices (time and cost) and a decline in quality (fewer options) [that] could force people onto what looks set to be a lucrative black market, as it has done for cigarettes". Moving on, the World Bank finally lifted its ban on nuclear energy. It really does seem like every country in the world is—or will soon—be embracing this clean, reliable source of energy. Except Australia, because... well, Energy Minister Chris Bowen decided he didn't like it and it's now Labor Party policy to post memes of three-eyed fish instead of having an adult discussion about Australia's future energy security (Peter Dutton's nuclear plan was bad because of how it was designed, not because nuclear itself is inherently flawed). Speaking of a country in need of more adult discussions, Trump's tariffs are already proving to be an unmitigated disaster for domestic US manufacturing. The policy uncertainty has led to almost 40% of manufacturers reportedly delaying or cancelling investments:  As for Elon Musk's DOGE, it might end up "being worse than ineffective in the long run". According to Scott Lincicome, any future reform efforts may simply "be derided and dismissed as simply 'pulling a DOGE'". But perhaps a bigger consequence was the dodgy means by which DOGE was established, which may have cleared the way for a future President to "further accelerate our slide toward one-man rule". Basically, institutions decay and Trump may have hastened the rot. Not only because of DOGE, but also because of how he—and past Presidents and Congresses—have handled the looming US debt crisis. Economist Ken Rogoff recently sat down with podcaster Dwarkesh Patel to discuss just that, pointing out that there are essentially four ways the US government can get out of its mess: default, financial repression, austerity, or inflation. Rogoff observed that inflation is the most likely for the US because it's politically the easiest to execute—the President and Congress have "so many" ways to force the independent Fed to breach its mandated 2% inflation target, especially if a shock comes around and they use it as an excuse to declare some kind of wartime or "war on pandemic" type situation. He thinks interest rates are going higher and will stay there. Finally, for the true econ nerds reading this newsletter you could do worse than read this twitter debate between a few ANU economists on superannuation taxes (alas, you'll probably need an account to view the replies). Basically, superannuation is already heavily taxed and the use of the word "concession" by people like Treasurer Chalmers is misplaced because the government isn't using an appropriate benchmark against which to calculate the "concession". It's very likely that all forms of non-property savings in Australia are taxed too heavily, and the fact that superannuation is taxed a bit less (not including its mandatory nature, which is itself a costly distortion) is no reason to raise its tax rate to match other poorly-calibrated taxes. If anything, taxes on savings in vehicles like like term deposits should be reduced to match the superannuation "concession". That's all for now. I'll be back with more in a few weeks! Have a great day. This email is subject to our Privacy policy and Terms of use and its contents should not be considered investment, legal, accounting, tax, or financial advice. © 2025 Aussienomics — Unsubscribe |